Professionals: Countless merchants and buys are qualified for income back again, and that means you’ll likely obtain specials in which you now store.

Line of Credit (LOC) Definition, Forms, and Examples A line of credit rating is undoubtedly an arrangement involving a financial institution as well as a client that establishes a preset borrowing Restrict which can be drawn on frequently.

Professionals: You’ll acquire cash again on in-retail outlet buys swiftly — typically inside 24 several hours. Ibotta also offers a welcome bonus to new end users, referral bonuses and many different payment strategies.

Payment routine: Zip employs the pay back-in-4 model. Your purchase is break up into 4 equivalent installments being compensated each two weeks, with the main owing at checkout.

Transaction velocity claimed depends upon particular person conditions and may not be obtainable for all transactions

Zelle payments land immediately inside your recipient’s checking account, which means there’s no hard cash out rate even if you need to obtain the funds quickly.

Particular financial loans: Particular loans provide a sum of cash that is certainly repaid in fixed monthly installments after a while. Own loans feature larger borrowing restrictions, plus some on-line lenders can fund a financial loan once another small business working day.

What's more, it has similar-day funding accessible In case you have a Visa debit card. Nevertheless it's more expensive to use than hard cash progress apps, so you'll want to Assess other credit score-constructing courses and choose if the credit-boosting aspect is definitely worth the Price.

You will discover fiscal aid plans for these fees as little one care, utilities and groceries should you qualify.

Delicate credit score check only: Unlike implementing for any charge card or financial loan, BNPL apps won’t usually perform a hard credit pull, which often can temporarily lessen your rating. Also, if you’re concerned about a reduced credit score score, you will have A neater time receiving accepted by a BNPL application than a traditional lender.

You may apply for around $a hundred in advances every day and approximately to $750 for every spend time period, providing you with some flexibility if you find yourself needing more than one advance between paychecks.

Payment extensions. Talk with your Invoice vendors about an extended payment approach or extension in your due date if you're driving on payments.

And for anyone apps like front pay wanting overtime to repay their money advance, Brigit makes it possible for thanks date extensions, whilst Grid will not. For every two consecutive developments repaid in time, you can request an extension, with the option to keep up a few extensions for long run use.

Revolut⁷ gives US prospects 3 unique account programs, which you'll be able to pick out In accordance with your individual Choices plus the providers you need to use.

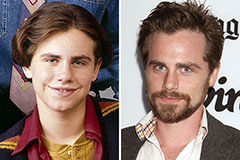

Rider Strong Then & Now!

Rider Strong Then & Now! Shaun Weiss Then & Now!

Shaun Weiss Then & Now! Bradley Pierce Then & Now!

Bradley Pierce Then & Now! Patrick Renna Then & Now!

Patrick Renna Then & Now! Raquel Welch Then & Now!

Raquel Welch Then & Now!